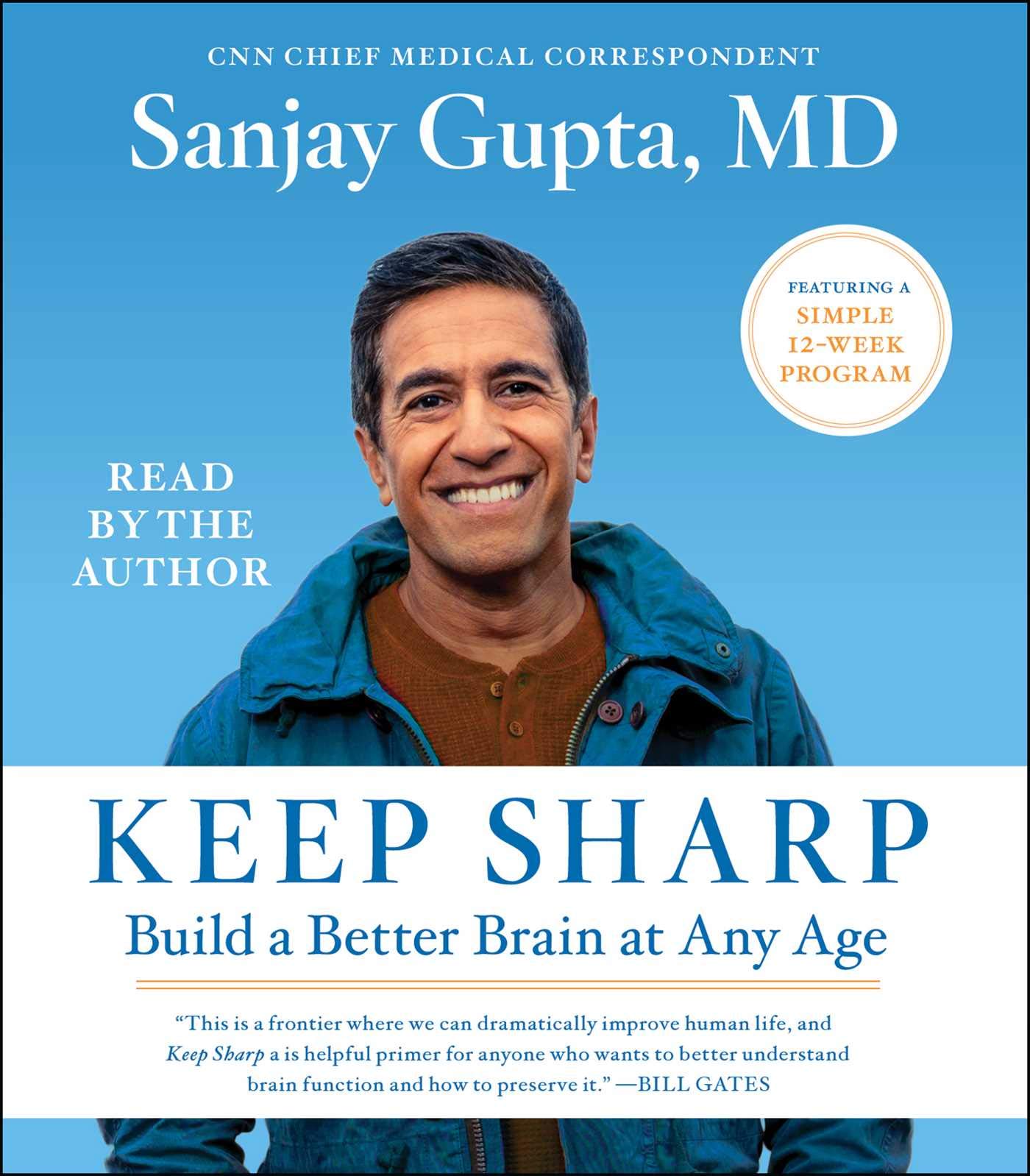

They say a stranger is just a friend you haven’t met yet. At Sift Healthcare, we believe some receivables are just a denial you haven’t met yet. Sift uses Artificial Intelligence (AI) and Machine Learning (ML) to demystify healthcare payments and we’d like to share with you four key areas you can focus on to recover missed receivables or accelerate cash.

- Target your ‘Zero allowed Zero Paid’ claims

- The easiest and quickest scenario to investigate the potential for hidden denials is by running a report on all closed balances where the paid amount and allowed amount are zero. Sometimes payers will send remittances without a denial reason code but didn’t pay. This can obfuscate denials because many denial reports and denial worklists are configured to report only on amounts associated with reason codes mapped as a denial.

- The easiest and quickest scenario to investigate the potential for hidden denials is by running a report on all closed balances where the paid amount and allowed amount are zero. Sometimes payers will send remittances without a denial reason code but didn’t pay. This can obfuscate denials because many denial reports and denial worklists are configured to report only on amounts associated with reason codes mapped as a denial.

- Find and data mine your clinical validation denials

- In some cases, revenue cycle leaders are blissfully unaware that clinical validation denials even exist. This is because payers issue clinical validation denials via letter instead of remittance and often do so retrospectively after sending the initial payment once the claim is closed. Many A/R systems and reports never even show these denials exist because of the timing and manner of issuance for these denials.

- The first step in remediating clinical validation denials is to understand where these letters are being routed to and how they’re being electronically logged (potentially by HIM, Case Management, Utilization Management, or your own correspondence scanning team). Once logged, you can begin to target which DRGs or diagnoses are common targets for clinical validation denials and work with CDI and physician leadership to ensure the clinical evidence supports the physician documentation that led to your added secondary diagnosis that led to the higher-weighted DRG or CC/MCC capture.

- Closely monitor your ‘patient/member’ and ‘benefits exceeded’ denials for dates of service in the first quarter of each plan year

- Many payer systems are late to update or reset their member rosters each plan year. This is especially true for many state Medicaid plans. This leads to a bolus of eligibility and benefits exhausted denials in the first one to three months of a calendar year (or plan year). In fact, many patient/member and benefits exceeded denials are mapped to the Patient Responsibility (PR) group code, which many A/R systems are configured to auto-adjudicate to self-pay, bypassing the denials management workflow altogether. Eventually, many of these payers will self-correct and issue recoupments and repayments on their own without staff ever having to intervene, but you can trend eligibility/benefits denials by payer to identify exactly when their plan year has not been refreshed in their systems and accelerate cash by alerting your payer rep to the issue sooner.

- Many payer systems are late to update or reset their member rosters each plan year. This is especially true for many state Medicaid plans. This leads to a bolus of eligibility and benefits exhausted denials in the first one to three months of a calendar year (or plan year). In fact, many patient/member and benefits exceeded denials are mapped to the Patient Responsibility (PR) group code, which many A/R systems are configured to auto-adjudicate to self-pay, bypassing the denials management workflow altogether. Eventually, many of these payers will self-correct and issue recoupments and repayments on their own without staff ever having to intervene, but you can trend eligibility/benefits denials by payer to identify exactly when their plan year has not been refreshed in their systems and accelerate cash by alerting your payer rep to the issue sooner.

- Establish leading and lagging KPIs for denial overturns to isolate problems in your Open Aged Trial Balance for denied and outstanding claims

- Everybody knows how much cash they brought in last month, but I always like to ask, “how much of your cash last month was from overturned denials?” Very few can answer that, and many A/R systems or reporting products cannot adequately map initial denial volumes to final payment outcomes.

- First, you need to know how much you’re overturning historically to establish baselines (lagging indicator). Sift’s ML-enabled Rev/Track reporting suite can do this. Using hindsight with the lagging indicator, you can easily tell retrospectively when staff’s time was better spent on the $100 overturn of the $1,000 claim than the time spent on the more complex $14,000 claim that required higher resource effort to overturn $0, but without a predictive leading indicator, traditional prioritization often directs staff to spend more time for less money on the more complex, higher dollar claim. Sometimes even when the gross amount or expected revenue is the size of a boulder, you won’t squeeze water out of the rock. Healthcare organizations that Sift works with leverage ML-generated propensity-to-overturn scores which demonstrate that 99 percent of an organizations overturned dollars are recovered in just 40 percent of the denials they receive. Sift believes that good process is self-managing and propensity-to-overturn scoring integrated back into your staff’s A/R system can help you prioritize the good and automate the bad.

- Everybody knows how much cash they brought in last month, but I always like to ask, “how much of your cash last month was from overturned denials?” Very few can answer that, and many A/R systems or reporting products cannot adequately map initial denial volumes to final payment outcomes.