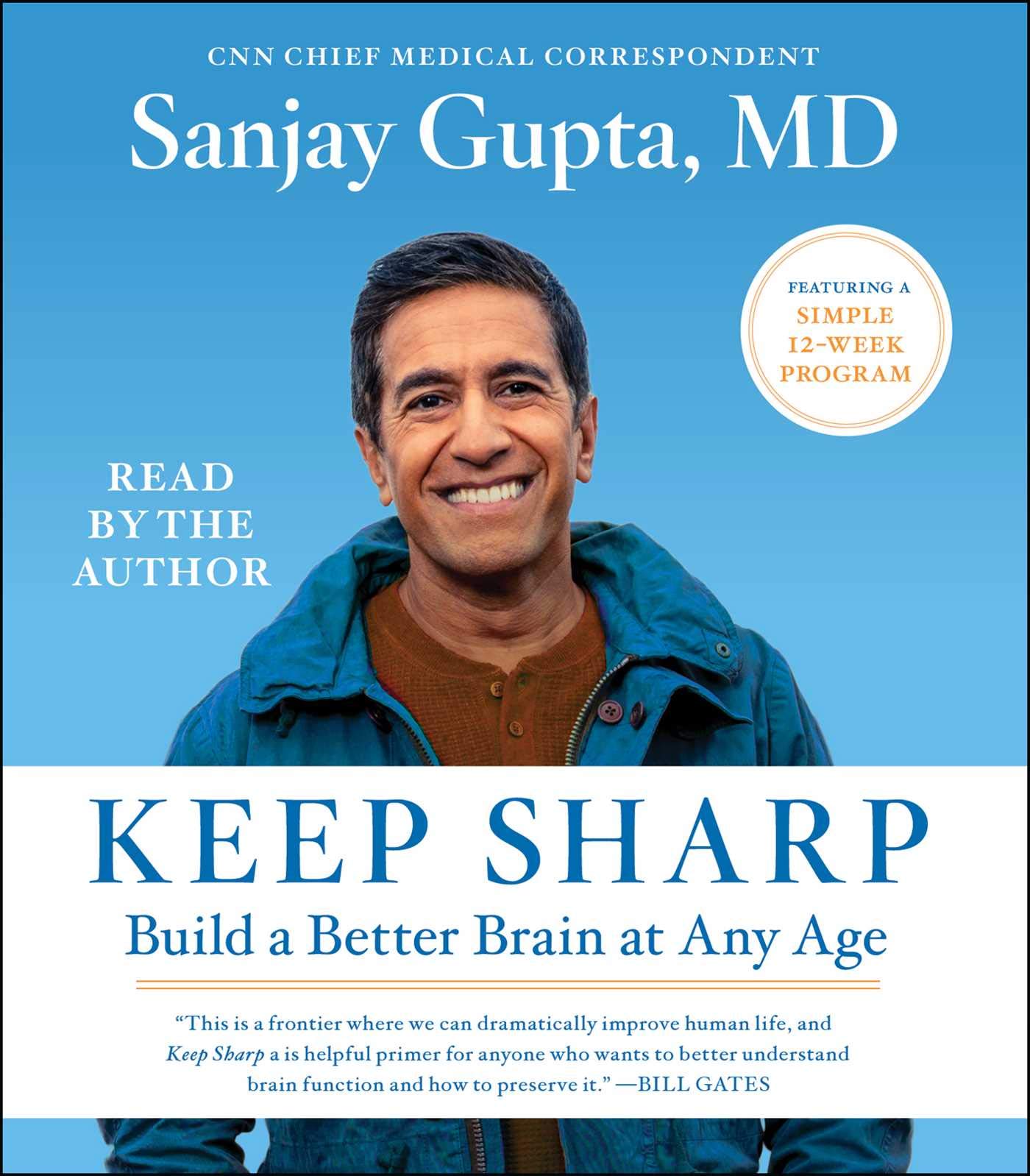

More lawsuits filed against the Inflation Reduction Act, while Congressional Democrats push additional reforms

Joining PhRMA, the U.S. Chamber of Commerce, Merck and Bristol Myers Squibb, pharma companies JanssenJ&J and Astellas filed July lawsuits against implementation of the IRA. The six lawsuits have now been filed in five different districts, resulting in what one analyst called a “multi-pronged legal attack”. While most of the lawsuits make similar arguments against the law, citing the First, Fifth and Eighth amendments, only the U.S. Chamber suit requests a preliminary injunction. If granted, a preliminary injunction could temporarily place agency implementation on hold. The flood of summer litigation comes just before the U.S. Department of Health & Human Services is scheduled to announce the first 10 Medicare Part D drugs that will be subject to price setting after negotiations. HHS plans to announce the drugs on September 1. Meanwhile, Democratic members of the House and Senate have introduced a bevy of legislation that seeks to increase the number of drugs that will ultimately be included in negotiation, move up timeframes (“negotiated” prices would not go into effect until 2026 under the IRA) and add new restrictions on drug pricing beyond what is included in the IRA. In late July, powerful Democratic congressman Frank Pallone (D-NJ), who previously served as chairman of the House Energy & Commerce Committee which oversees many aspects of health policy, introduced legislation to expand the IRA from Medicare only to all private health insurance plans, including those offered within the Affordable Care Act (ACA) framework. His bill has garnered support from 40 other House members, all of them Democrats. Similar legislation has been introduced in the Senate.

COVID Public Health Emergency “unwind” continues on multiple fronts

In light of this spring’s expiration of the COVID-19 Public Health Emergency (PHE), government agencies and health care providers continue to grapple with an evolving landscape. In early August CMS finalized its plan to end hospital add-on payments for COVID-19 treatments on October 1. The New COVID- 19 Treatments Add-On Payment (NCTAP) has been in effect since November, 2020, and was designed to mitigate potential financial disincentives for hospitals to provide new COVID-19 treatments during the now-ended public health emergency. Through the policy, Medicare has provided extra payments to hospitals for eligible inpatient cases where certain new COVID-19 products either granted FDA approval or emergency use authorization were used, including the oral antiviral treatments Paxlovid (nirmatrelvir/ritonavir), Lagevrio (molnupiravir) and the treatment Veklury (remdesivir). On another health care front, CMS announced August 2 that states can continue their home and community-based services Appendix K waivers past November 11, when the COVID-19 era waivers are otherwise set to expire, as long as the states apply to fold them into their 1915(c) waiver programs. The agency issued guidance for states and pledged to work with officials to continue the waivers, if possible. Meanwhile 12 states paused Medicaid disenrollments in late July after federal health officials expressed concern that too many people were being disenrolled due to procedural, rather than eligibility reasons. The Kaiser Family Foundation released a study in July stating that about 75% of disenrollments nationwide were based on procedural reasons.

Medicare Part D premiums expected to be slightly lower for 2024

On July 31, CMS announced that average 2024 Medicare Part D monthly premiums will trend down to $55.50, a 1.8% decrease from the projected $56.49 monthly premium in 2023. CMS says the expected stable premiums for Medicare prescription drug coverage in 2024 are due to Part D improvements required by the Inflation Reduction Act. The announcement comes a few months before the Medicare open enrollment period for 2024 coverage begins October 15.

Capitol Hill expresses concern over increasing reliance on China for essential medicines

Post the COVID-19 pandemic and in light of ongoing international tensions with China, many members of Congress—on both sides of the aisle—are expressing concern and demanding changes to ensure U.S. patients have access to essential medicines in the future. Earlier this year, the FDA quietly approved an emergency request to import a cancer drug in short supply in the U.S. from a Chinese manufacturer. The FDA’s emergency import of medicine from China shows just how reliant America has become on Chinese manufacturers of active pharmaceutical ingredients (APIs) for a range of products from cancer therapeutics and antibiotics to the ingredients in the Adderall used to treat attention deficit hyperactivity disorder (ADHD). The reliance on active pharmaceutical ingredients made in China deepened during the pandemic. In response, members of Congress have introduced a series of bills to address the issue, some of which include penalties for companies that rely too heavily on Chinese supplied API. Leading Republican voices on the issue include Sen. Tom Cotton (R-AR), Rep. Mike Gallagher (R-WI), Diana Harshbarger (R-TN) and Buddy Carter (R-GA). Cotton and Gallagher’s legislation proposes bold steps including language to “ban the use of Federal funds for the purchase of drugs manufactured in the People’s Republic of China.” While U.S. policymakers generally seem to agree that more domestic manufacturing is critical to ensuring access to essential medicines, there is little agreement on how to get it done. In late July, President Joe Biden signed an executive order that requires the heads of various federal agencies to work together to identify opportunities to expand American manufacturing, heralding the Administration’s intent to work with businesses to “invent it here, make it here”. Regardless of the preferred approach, the issue is emerging as a potential bipartisan policy opportunity for action in the coming months.