February is make or break time for Congressional budget negotiations…and we’re already behind on the 2025 process

Thanks to another round of the legendary “kick the can” game, the federal government did not shut down in January. Congress managed to pass a short-term spending bill to fund the government through the month of February. However, budget negotiators must reach agreement (and find sufficient votes in the Republican and Democrat caucuses) by March 1. The latest resolution is the third passed by Congress to prevent a government shutdown this fiscal year. As we approach the middle of a shorter-than-normal month, movement toward some sort of final funding agreement doesn’t seem to be materializing quickly on Capitol Hill. One issue complicating an agreement is border security, with some Republicans pressing Congressional leaders to enact new controls on illegal immigration. A new bipartisan bill to address the issue was released earlier this week but was declared “dead on arrival” in the Senate, especially after former President Donald Trump (who is also the likely GOP nominee this November) panned the bipartisan proposal, stating it would allow continuation of Biden’s policies that “cause death, destruction and chaos in every American community”. The most contentious immigration provision in the bill would allow the government to close the border, but only after migrant crossings surpass a threshold of 5,000 per week. Also impacted by the impasse are billions of dollars in funding to support Ukraine and Israel. Health care providers are also feeling a pinch, as anticipated payment delays from Medicare begin to materialize. Congressional budget negotiators are already several months behind on negotiating the 2025 federal budget. Suffice it say, the final week of February likely won’t be fun to watch!

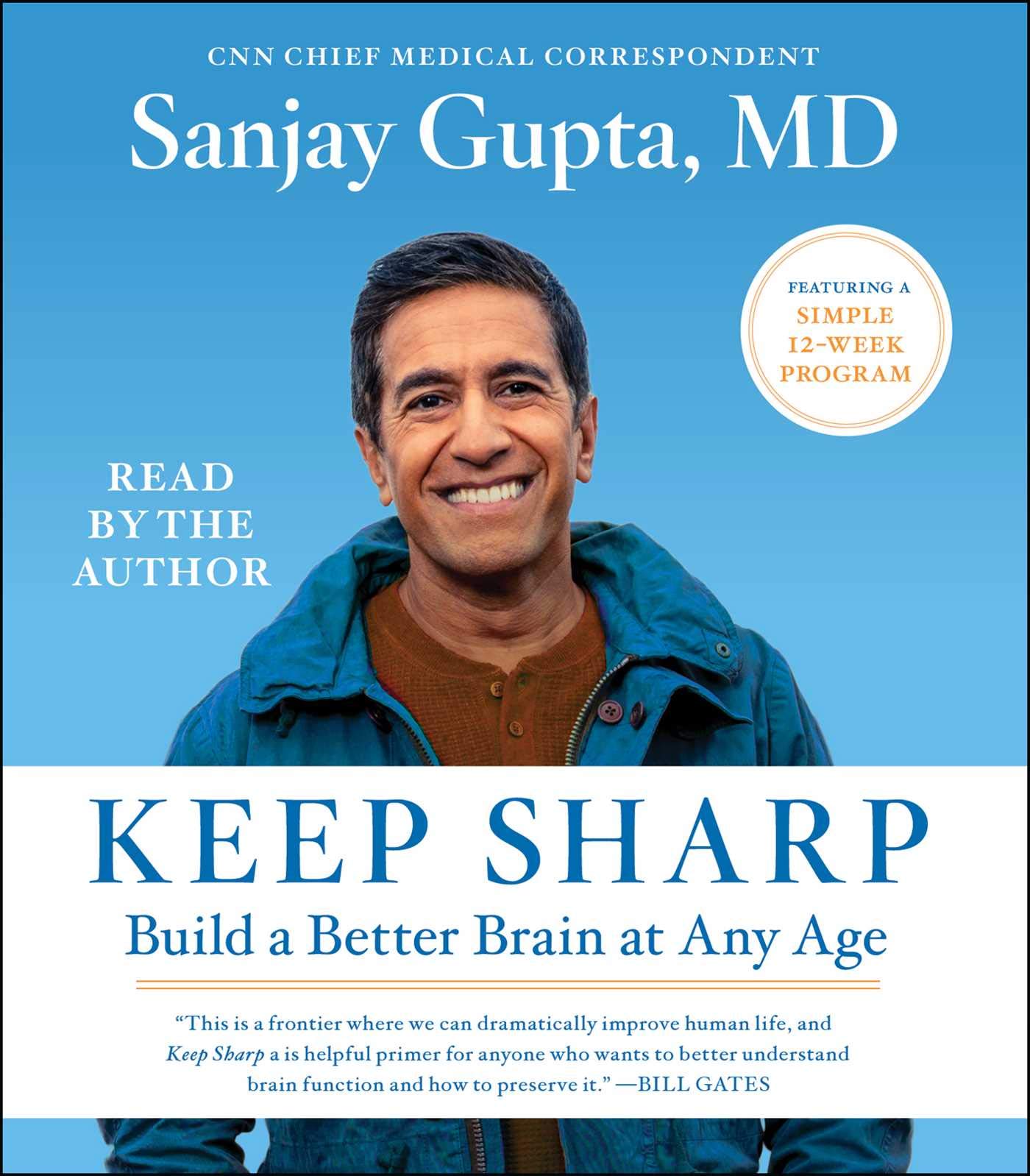

Medicare’s initial “maximum fair price” offer in the hands of drugmakers; PhRMA blasts lack of transparency

Right on schedule, the Centers for Medicare & Medicaid Services (CMS) provided companies with Part D medicines on the Top 10 list for Medicare negotiation its initial offer of a “maximum fair price” (MFP) on February 1. Companies have until March 2 to accept the agency’s initial MFP (which limits what the government will pay for the product in Medicare Part D) or provide a counteroffer. If the company doesn’t accept the initial offer (which no one expects a company to do), CMS and the company will enter a negotiation process that could extend through much of the summer. Companies aren’t commenting on the initial price offer, but PhRMA blasted the agency for not providing transparency on how the prices were determined and said the Biden Administration is simply using the opportunity to score political points. “Government bureaucrats are operating behind closed doors to set medicine prices without disclosing for months how they arrived at the price or how much patient and provider input was used,” a PhRMA spokesman said in a statement. “This lack of transparency and unchecked authority will have lasting consequences for patients long after this administration is gone.” CMS countered that it factored the following in its initial price offers for the 10 selected drugs: therapeutic alternatives, clinical benefits and input from public listening sessions. President Biden marked the occasion by saying he is “taking on big pharma” and accusing Republicans of being allies of the biopharmaceutical companies by opposing efforts to lower drug prices.

What’s the future for “copay accumulator” programs? Watch CMS closely for its next move

With the Biden Administration’s decision to abandon its appeal of a recent court decision which found most payer/pharmacy benefit manager “copay accumulator” programs were not permissible under provisions in the Affordable Care Act (ACA), patient advocates celebrated…but the celebration will need to followed by continued pressure on the U.S. Department of Health & Human Services (HHS). The 2020 HHS rule in question allowed insurers not to count drug manufacturer copay assistance towards a beneficiary’s deductible and out-of-pocket maximum. With the withdrawal of the appeal, the previous rule is now in effect. However, the 2024 Benefit Designs are already in effect, leading to ongoing monitoring of the forthcoming 2025 CMS/HHS proposed rule, which should offer needed clarification. Advocates are pleased, but pledge to remain vigilant. “Now that the government has dropped its appeal, we hope this is a signal they will accept and enforce the court ruling and issue guidance stating that copay assistance, in most instances, must count for patients,” said George Huntley, CEO of the Diabetes Leadership Council and the Diabetes Patient Advocacy Coalition said in a press release after the appeal was withdrawn. “They also have stated they will pursue a new rule regarding copay assistance. While the current rule is sufficient in our view and remains in effect, if they move forward with a new rule, it must ensure that copay assistance counts.” Meanwhile, most state legislatures are back in session and state legislation on the accumulator front is likely to continue to be active. To keep updated on federal and state developments, visit the All Copays Count Coalition website to receive email updates.

CMS releases ambitious timeframes for Cell & Gene Therapy Access Model; Key questions remain

On the heels of FDA approval of two new gene therapies to treat sickle cell disease, the CMS Center for Medicare & Medicaid Innovation (CMMI) released additional details and resources related to its Cell & Gene Therapy Access Model on January 30. Not surprisingly, CMMI announced its initial focus will be on sickle cell disease. The goal of the model, which was created as part of President Biden’s challenge to government agencies to find additional ways to lower prescription drug pricing beyond the 2022 Inflation Reduction Act (IRA), is to allow CMS to assume the negotiator role with companies on behalf of states. The negotiations will focus on innovative pricing models and outcomes-based agreements that theoretically will expand access to innovative cell and gene therapies for people with Medicaid. The federal government estimates about 60% of sickle cell patients in the U.S. rely on Medicaid for health insurance and that anywhere from 30,000-40,000 sickle cell patients on Medicaid could be eligible for gene therapies. Response to the January details was generally cautious, with industry observers and patient advocates believing that the model could be valuable in ensuring access, but some worry that CMS will be too narrowly focused on driving down price, which could negatively impact innovation in the cell and gene therapy space. The model’s ambitious timeline calls for extensive work in 2024 with a 2025 rollout. The questions that remain to be answered? How many states and manufacturers (of which there are just a handful at this early juncture) will agree to participate in the voluntary model? How will other states respond if they choose to go it on their own with manufacturer negotiations? How will CMS approach the negotiations—with a constructive, open mind to innovative payment models or a laser focus on getting the price as low as possible? What might happen to the model if President Biden is defeated in November? Regardless of the answers to each of those questions, 2024 is becoming an extremely pivotal year for the cell and gene therapy community.

Health Policy Snippets:

- The Congressional Budget Office (CBO) could be looking deeper and wider for impact determinations: House Republicans have advanced legislation that would require the powerful CBO to consider the savings and long-term benefits of preventative health when considering legislation. Currently CBO looks at potential savings over a 10-year window. Legislation advanced last week by the House Budget Committee would require CBO to consider anticipated savings over 30 years. The bill passed with broad bipartisan support. Text of HR 766 can be found here.

- Medicaid “Unwinding”: Medicaid rolls grew to cover about 94 million people during the COVID pandemic. Now that the public health emergency has ended and states go about the laborious process of determining who should still receive assistance, more than 16 million have been removed from the rolls. Kaiser Family Foundation (KFF) believes the unwinding process to determine eligibility will ultimately make the Medicaid enrollment numbers look similar to numbers before the pandemic. For more information, visit the KFF unwinding resource center, which outlines state-by-state projections.